Opening a company in Lithuania is the best option for businessmen interested in simple company registration and simple working conditions. The state also attracts business representatives due to its stability.

Entrepreneurship in the territory of Lithuania has many strengths the ease of management of the firm and the conduct of activities, a large selection of banks, their loyalty, stable legislation, flexibility of business forms, simple accounting system, If a businessman decides to register a company in Lithuania as an open joint stock company, there are ways to hide personal information.

If a businessman has decided to start a firm with a certain name, it should not repeat existing ones or be very similar to them. If the name of the company uses words that are directly or indirectly related to the Government or State, the registration of the firm will be refused. Certain words, such as insurance or bank, must be licensed for use in the name. The name allows the termination of B.V., N.V., COOP, as well as any other words that reflect the nature of the company.

The price of open a company in Lithuania is influenced by many factors, including the chosen organizational and legal form of the company. The most popular is the Limited Liability Company. At least one director and one shareholder are required. It is possible to open a company in Lithuania in other legal forms, for example, open joint-stock company. To do this, you need to deposit the authorized capital of 45 thousand. Euro. The company should be at least one shareholder and director. Two other legal forms are cooperative (UA) and limited partnership (CV). In both cases, there are no capital requirements, but there must be at least two shareholders and one director. In a company of type UA to create a structure does not need a beneficiary, and in the case of CV it can be anonymous. In all cases, directors and shareholders may be not only natural but also legal persons.

The private fund can be used as a shareholder of BV. This allows the beneficiary to obtain all certificates of the fund. An investment fund can be established by means of a notarial act and then registered in the Lithuanian Trade Register. The Fund is transparent for tax purposes and does not need to audit and report. The Fund may own any property, including shares of both local and foreign companies. It may issue certificates of ownership of such property. These certificates may be held by any natural or legal person whose personal data are not transferred anywhere and are not public.

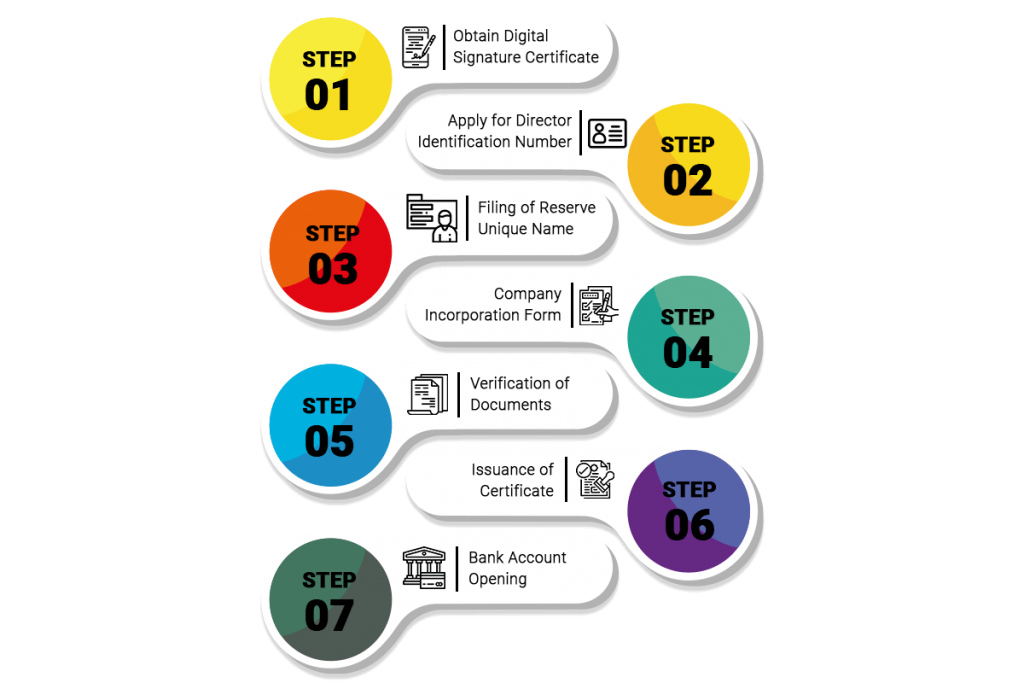

Businessmen can start business in Lithuania by completing the following obligatory actions by choosing and agreeing on the name of the company, having determined the desired location of the company’s office, having created the foundation agreement and developed the charter, To open a technical account in the Bank of Lithuania for the payment of the authorised capital, having deposited funds and received a certificate from the bank, having passed the whole procedure of registration of the company, having entered the corresponding entry in the state register and opened a permanent bank account of the company. You do not have to do these actions yourself, as to open a company in Lithuania can specialists. They minimize your involvement in the process by providing the necessary advice. For example, they will advise you the most popular and profitable types of business today in Lithuania.